Picture 1 of 7

Gallery

Picture 1 of 7

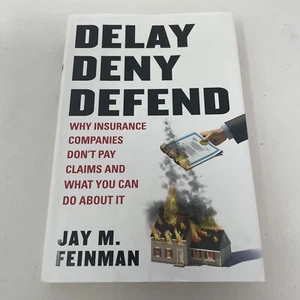

Delay, Deny, Defend: Why Insurance Companies Don't Pay Claims 9781591843153

US $119.99

ApproximatelyAU $184.88

or Best Offer

Condition:

Good

A book that has been read but is in good condition. Very minimal damage to the cover including scuff marks, but no holes or tears. The dust jacket for hard covers may not be included. Binding has minimal wear. The majority of pages are undamaged with minimal creasing or tearing, minimal pencil underlining of text, no highlighting of text, no writing in margins. No missing pages. See the seller’s listing for full details and description of any imperfections.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Postage:

US $6.13 (approx. AU $9.45) USPS Media MailTM.

Located in: Denver, Colorado, United States

Delivery:

Estimated between Wed, 11 Jun and Sat, 14 Jun to 94104

Returns:

30-day returns. Buyer pays for return postage. If you use an eBay postage label, it will be deducted from your refund amount.

Payments:

Shop with confidence

Seller assumes all responsibility for this listing.

eBay item number:267148537538

Item specifics

- Condition

- ISBN

- 9781591843153

About this product

Product Identifiers

Publisher

Penguin Publishing Group

ISBN-10

1591843154

ISBN-13

9781591843153

eBay Product ID (ePID)

77479953

Product Key Features

Book Title

Delay Deny Defend : Why Insurance Companies Don't Pay Claim and What You Can Do about It

Number of Pages

256 Pages

Language

English

Publication Year

2010

Topic

Insurance / General

Genre

Business & Economics

Format

Hardcover

Dimensions

Item Height

1 in

Item Weight

15.6 Oz

Item Length

9.3 in

Item Width

6.3 in

Additional Product Features

Intended Audience

Trade

LCCN

2009-041912

Dewey Edition

22

Reviews

"As a trial lawyer fighting these battles every day, I can tell you that the insurance industry has mutated from a business that was bound by promise and contract to one of profit-through-deception. Feinman focuses the bright light of truth on an industry that, like the financial services industries it is tied to, has run amok. This is a book all Americans need to read."- John Elliott Leighton, Esq. , chairman, The Academy of Trial Advocacy "Jay Feinman's book shows how, time and again, policyholders with legitimate claims encounter nothing but resistance from insurance companies, leaving people frustrated and angry, and sometimes, destitute. Luckily, he provides some great suggestions about how consumers can fight back. This book is a must-read for anyone who needs insurance to function-and that's everyone!"- Joanne Doroshow , executive director, Center for Justice & Democracy "Feinman explains how America''s premier insurance companies systematically rip off consumers. Do not settle your auto or home insurance claim without reading this book---you could avoid losing hundreds, thousands, or even millions of dollars that you are owed."- J. Robert Hunter , director of insurance, Consumer Federation of America "Jay Feinman has found all the puzzle pieces and fit them into the complete picture of how insurers cheat, who's working to stop them, and what you can do to protect yourself." - Amy Bach , executive director, United Policyholders, "As a trial lawyer fighting these battles every day, I can tell you that the insurance industry has mutated from a business that was bound by promise and contract to one of profit-through-deception. Feinman focuses the bright light of truth on an industry that, like the financial services industries it is tied to, has run amok. This is a book all Americans need to read."-- John Elliott Leighton, Esq. , chairman, The Academy of Trial Advocacy "Jay Feinman's book shows how, time and again, policyholders with legitimate claims encounter nothing but resistance from insurance companies, leaving people frustrated and angry, and sometimes, destitute. Luckily, he provides some great suggestions about how consumers can fight back. This book is a must-read for anyone who needs insurance to function--and that's everyone!"-- Joanne Doroshow , executive director, Center for Justice & Democracy "Feinman explains how America's premier insurance companies systematically rip off consumers. Do not settle your auto or home insurance claim without reading this book---you could avoid losing hundreds, thousands, or even millions of dollars that you are owed."-- J. Robert Hunter , director of insurance, Consumer Federation of America "Jay Feinman has found all the puzzle pieces and fit them into the complete picture of how insurers cheat, who's working to stop them, and what you can do to protect yourself." -- Amy Bach , executive director, United Policyholders, "As a trial lawyer fighting these battles every day, I can tell you that the insurance industry has mutated from a business that was bound by promise and contract to one of profit-through-deception. Feinman focuses the bright light of truth on an industry that, like the financial services industries it is tied to, has run amok. This is a book all Americans need to read."- John Elliott Leighton, Esq. , chairman, The Academy of Trial Advocacy "Jay Feinman's book shows how, time and again, policyholders with legitimate claims encounter nothing but resistance from insurance companies, leaving people frustrated and angry, and sometimes, destitute. Luckily, he provides some great suggestions about how consumers can fight back. This book is a must-read for anyone who needs insurance to function-and that's everyone!"- Joanne Doroshow , executive director, Center for Justice & Democracy "Feinman explains how America's premier insurance companies systematically rip off consumers. Do not settle your auto or home insurance claim without reading this book---you could avoid losing hundreds, thousands, or even millions of dollars that you are owed."- J. Robert Hunter , director of insurance, Consumer Federation of America "Jay Feinman has found all the puzzle pieces and fit them into the complete picture of how insurers cheat, who's working to stop them, and what you can do to protect yourself." - Amy Bach , executive director, United Policyholders

Grade From

Twelfth Grade

Dewey Decimal

368/.0140973

Grade To

UP

Synopsis

An expose of insurance injustice and a plan for consumers and lawmakers to fight it Over the last two decades, insurance has become less of a safety net and more of a spider's web: sticky and complicated, designed to ensnare as much as to aid. Insurance companies now often try to delay payment of justified claims, deny payment altogether, and defend these actions by forcing claimants to enter litigation. Jay M. Feinman, a legal scholar and insurance expert, explains how these trends developed, how the government ought to fix the system, and what the rest of us can do to protect ourselves. He shows that the denial of valid claims is not occasional or accidental or the fault of a few bad employees. It's the result of an increasing and systematic focus on maximizing profits by major companies such as Allstate and State Farm. Citing dozens of stories of victims who were unfairly denied payment, Feinman explains how people can be more cautious when shopping for policies and what to do when pursuing a disputed claim. He also lays out a plan for the legal reforms needed to prevent future abuses. This exposé will help drive the discussion of this increasingly hot- button issue.

LC Classification Number

HG8107F45 2010

Item description from the seller

Seller feedback (1,251)

- b***a (159)- Feedback left by buyer.Past monthVerified purchaseItem just as described and received in a timely fashion. Item was packed well. Good pricing. Would recommend this seller.

- g***e (38)- Feedback left by buyer.Past 6 monthsVerified purchaseComic arrived on time just as described/pictured in great condition. For an out of print/fairly rare TPB, I'd say the item was priced well. Good experience and I would purchase from this seller again.New Mutants by Vita Ayala and Rod Reis Volume 1 Marvel Comics 9781302927875 (#267137316643)

- 3***3 (424)- Feedback left by buyer.Past 6 monthsVerified purchaseProduct was just as described. Item was packaged very well and arrived on time. Awesome seller, I look forward to doing business again soon. Thank you very much!!FOR PARTS/ REPAIR - Microsoft Xbox One Black Controller Model 1914 - STICK DRIFT (#267125889068)

Product ratings and reviews

Most relevant reviews

- 19 May, 2016

The book insurance companies don't want you to read.

Verified purchase: YesCondition: Pre-ownedSold by: betterworldbooks

More to explore:

- Insurance Non-Fiction Hardcover Books,

- Insurance School Textbooks & Study Guides,

- Non-Fiction Paperback Fiction & Insurance Books,

- Non-Fiction Insurance Fiction & Non-Fiction Books,

- Non-Fiction Insurance Fiction & Non-Fiction Books in English,

- Defenders Comics, Graphic Comic Books,

- Defenders Comics, Graphic Novels & TPBs,

- Superheroes Defenders Comics, Graphic Novels & TPBs,

- Defenders 9.8 Near Mint/Mint Comics, Graphic Comic Books in English,

- Defenders 9.8 Near Mint/Mint Comic Book 1st Edition Comics, Graphic Novels & TPBs